Structure Confidence: Dependable Trust Foundations

Structure Confidence: Dependable Trust Foundations

Blog Article

Safeguarding Your Possessions: Depend On Structure Expertise within your reaches

In today's intricate financial landscape, making certain the safety and security and development of your assets is extremely important. Depend on foundations offer as a keystone for protecting your wide range and legacy, providing a structured approach to possession protection.

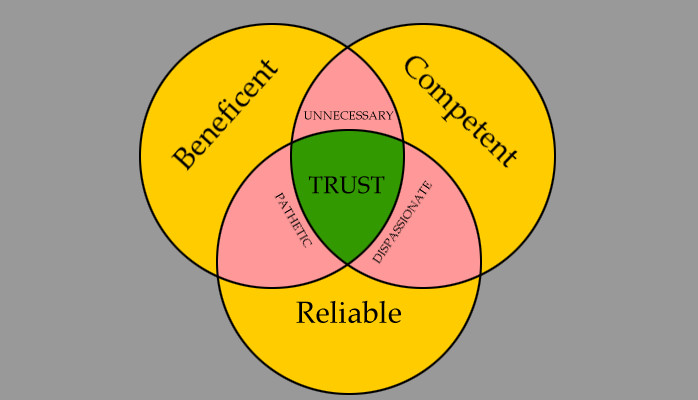

Value of Trust Fund Structures

Count on structures play a critical function in developing reliability and promoting solid partnerships in numerous expert settings. Count on structures serve as the cornerstone for honest decision-making and clear interaction within companies.

Benefits of Professional Support

Building on the structure of trust fund in specialist relationships, looking for professional advice supplies indispensable benefits for individuals and companies alike. Specialist guidance offers a riches of knowledge and experience that can help navigate intricate financial, lawful, or calculated obstacles effortlessly. By leveraging the competence of experts in various areas, people and companies can make educated decisions that line up with their goals and desires.

One significant benefit of professional advice is the capability to access specialized knowledge that may not be easily offered otherwise. Experts can offer understandings and perspectives that can result in cutting-edge solutions and chances for growth. Additionally, dealing with professionals can help alleviate dangers and unpredictabilities by giving a clear roadmap for success.

Additionally, professional advice can conserve time and sources by improving procedures and staying clear of pricey blunders. trust foundations. Specialists can offer tailored advice customized to particular needs, making certain that every choice is well-informed and calculated. In general, the advantages of expert guidance are complex, making it a useful property in safeguarding and making the most of possessions for the long-term

Ensuring Financial Safety And Security

In the world of financial planning, securing a steady and flourishing future rest on critical decision-making and prudent investment options. Ensuring economic safety involves a multifaceted technique that encompasses various aspects of riches monitoring. One crucial component is developing a varied financial investment profile customized to specific threat tolerance and financial objectives. By spreading financial investments across various property courses, such as stocks, bonds, real estate, and assets, the risk of substantial financial loss can be alleviated.

Additionally, preserving a reserve is important to secure versus unforeseen expenditures or income interruptions. Professionals recommend establishing aside 3 to Learn More Here six months' well worth of living expenses in a liquid, quickly obtainable account. This fund functions as a financial safety and security net, offering comfort throughout stormy times.

On a Visit This Link regular basis assessing and changing financial strategies in response to changing circumstances is likewise extremely important. Life occasions, market changes, and legislative adjustments can influence financial stability, underscoring the significance of recurring assessment and adaptation in the pursuit of long-lasting financial safety and security - trust foundations. By carrying out these methods thoughtfully and constantly, people can fortify their monetary ground and work towards a much more protected future

Securing Your Possessions Properly

With a strong foundation in place for economic security through diversity and emergency fund upkeep, the next essential action is protecting your properties successfully. One efficient approach is property allocation, which includes spreading your investments across different property classes to reduce danger.

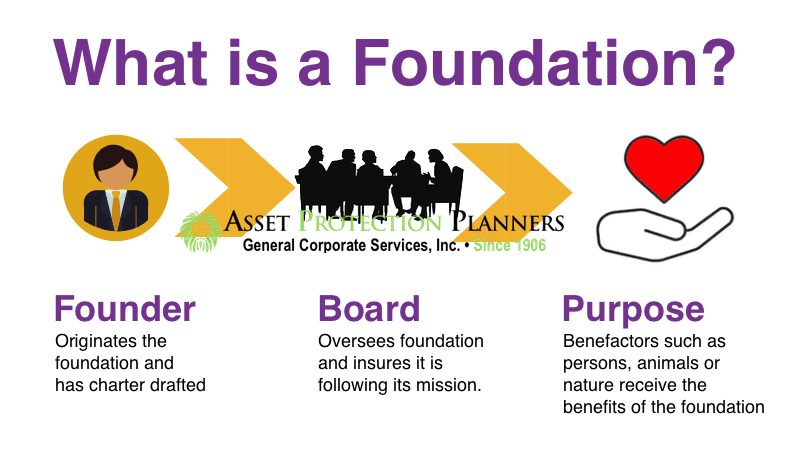

In addition, establishing a trust fund can offer a safe and secure means to safeguard your assets for future generations. Counts on can help you control how your properties are dispersed, minimize estate tax obligations, and protect your riches from financial institutions. By applying these techniques and looking for expert advice, you can protect your assets efficiently and protect your economic future.

Long-Term Asset Protection

To ensure the long-term security of your wealth against potential risks and unpredictabilities in time, critical preparation for long-term property defense is important. Lasting asset protection includes implementing actions to dig this protect your possessions from numerous hazards such as economic recessions, lawsuits, or unforeseen life occasions. One crucial facet of lasting asset security is establishing a depend on, which can use significant benefits in securing your possessions from financial institutions and lawful conflicts. By transferring possession of possessions to a trust, you can safeguard them from potential risks while still retaining some degree of control over their administration and distribution.

Additionally, diversifying your financial investment profile is one more key approach for long-term asset protection. By taking a proactive method to long-lasting property defense, you can secure your riches and give economic security for on your own and future generations.

Final Thought

In final thought, count on foundations play an important function in protecting possessions and guaranteeing financial safety and security. Professional assistance in establishing and taking care of depend on structures is necessary for long-lasting possession defense. By making use of the competence of experts in this area, people can effectively secure their possessions and strategy for the future with confidence. Depend on foundations give a strong structure for safeguarding wide range and passing it on to future generations.

Report this page